Whitepaper: The Strategic Importance of Selecting the Right Software for Aviation and MRO Organizations

The aviation and Maintenance, Repair, and Overhaul (MRO) industries are among the most complex and regulated sectors in the world. To thrive, organizations must balance operational efficiency, compliance with stringent regulations, and cost management—all while meeting the demands of a rapidly evolving market. Enterprise Resource Planning (ERP) systems, also known as M&E (Maintenance & Engineering) systems or aviation software, serve as the backbone for managing these challenges. However, the decision to select an ERP is not one to take lightly. The wrong choice can lead to inefficiencies, compliance risks, and financial strain, while the right aircraft maintenance software can transform operations, drive innovation, and unlock growth potential.

The Challenge of Software Selection in Aviation and MRO

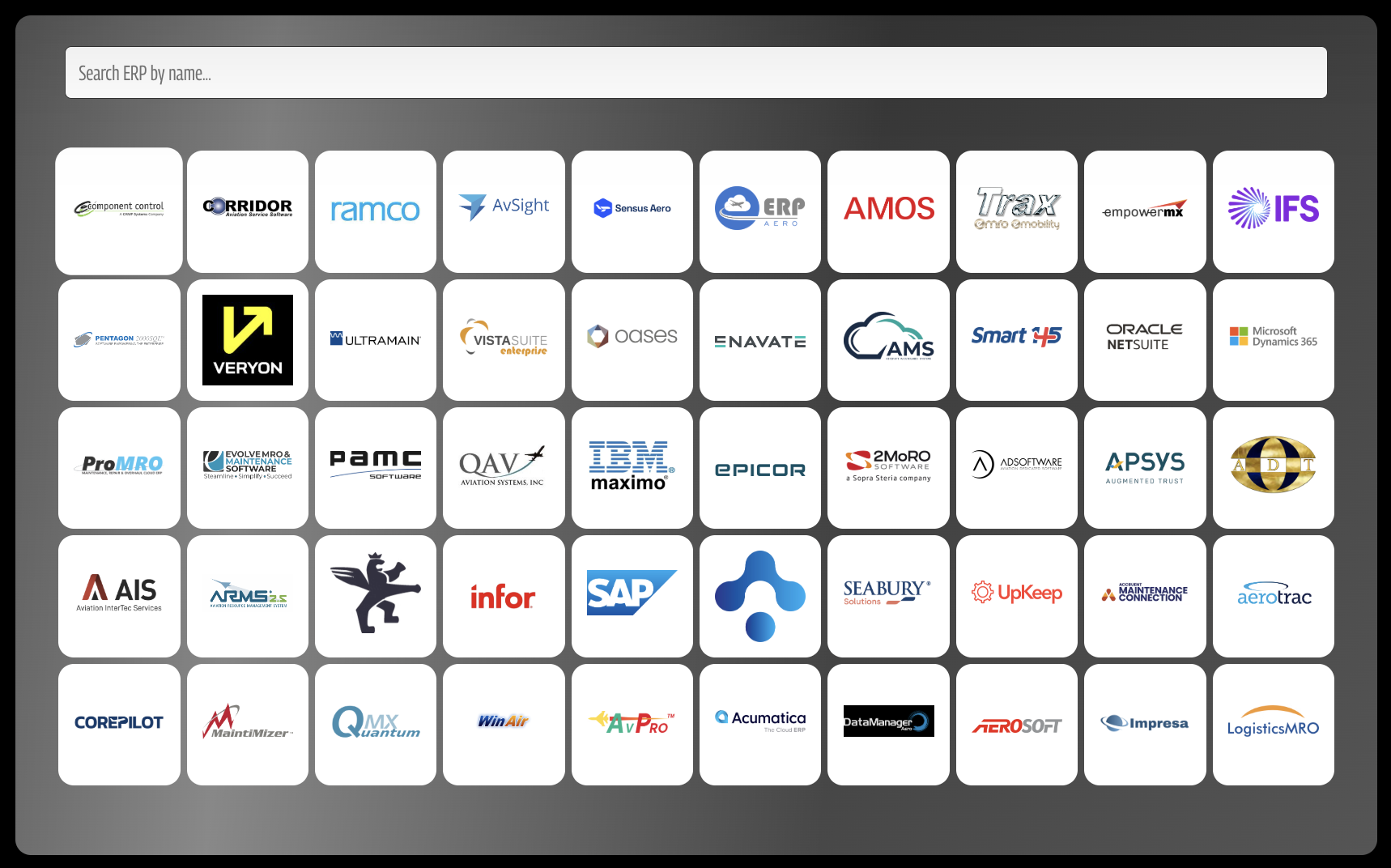

Selecting a maintenance software for aviation and MRO organizations is a daunting task, given the number of options available (>50) and the unique demands of the industry. Aviation workflows are inherently complex, involving intricate processes like work order maintenance management, inventory levels, compliance reporting, and supply chain coordination. Generic aviation software often fail to meet these specialized needs, leaving organizations with costly customizations, workarounds and inefficiencies.

Adding to the complexity is the issue of legacy systems. Many aviation organizations continue to rely on outdated ERP platforms, believing the time and cost of migrating to a new system is a sunk cost not worth paying for. Unfortunately, this reluctance to change often backfires. Legacy software providers, aware that their customers are hesitant to switch, invest minimally in product development. As a result, these systems lag behind in adopting new technologies like predictive analytics, IoT, and machine learning, leaving organizations at a competitive disadvantage. Many in such cases, implement software that sit outside the ERP causing an even more disjointed system and data architecture.

The Effects of Selecting the Wrong Maintenance Software

The consequences of choosing the wrong M&E software can be destructive. Operational bottlenecks are a common outcome, as disconnected systems and poor integration lead to inefficiencies across departments. For instance, an MRO organization that relies on a system with limited traceability of existing inventory and the condition of these parts may struggle with placing purchase orders, not knowing what parts to buy and when they will be needed, causing supply chain delays, but also creating a pool of excess and inactive parts.

Compliance risks are another significant concern. The aviation industry is governed by strict regulations, and failure to meet these standards can result in large fines and reputational damage. A poorly chosen software may lack the robust tracking and reporting capabilities needed to ensure compliance, putting the organization at risk.

Cost implications also extend beyond the initial investment. Organizations often underestimate the hidden costs of a poorly implemented aviation software, including increased maintenance expenses, employee training, and the eventual need for system migration. Furthermore, employee productivity can take a hit when staff are forced to work with non-intuitive interfaces and inefficient workflows, leading to frustration and reduced accountability – “The system doesn’t allow us to do that.”

Challenges of MRO Software Providers Today

MRO software providers face several challenges as they strive to meet the evolving needs of the aviation industry. These challenges include:

Legacy System Integration - Many MROs are still reliant on outdated legacy systems, making it difficult for software providers to implement modern solutions. Integrating advanced tools with these systems often requires significant customization, increasing complexity, cost, and implementation timelines.

Resistance to Change – Aviation organizations are often hesitant to adopt new software due to concerns about disruption to operations, high training costs, and the perceived risks of transitioning from legacy systems. Overcoming this resistance requires robust change management strategies and clear communication of the ROI and benefits.

Siloed Systems and Data Management - MROs frequently operate in environments with siloed systems that lack integration. This creates challenges for software providers in ensuring seamless data flow, collaboration, and accessibility across different departments and stakeholders.

Labor Shortages and Workforce Adaptation - With the aviation industry facing labor shortages and rising workforce costs, software providers need to design solutions that optimize workforce productivity and are intuitive enough to be adopted by a diverse range of employees.

Regulatory Compliance - Aviation is a highly regulated industry, and software providers must ensure their solutions comply with complex and changing regulations. This requires continuous updates, rigorous testing, and a deep understanding of global aviation standards.

Customization vs. Standardization – Aviation businesses often demand highly customized solutions to address their unique operational needs. Balancing this demand with the scalability and cost-efficiency of standardized software is a significant challenge for providers.

Cybersecurity Risks - With the increasing reliance on digital tools and cloud-based platforms, aviation MRO software providers face growing concerns about data breaches, insider threats, and other cybersecurity risks. Ensuring robust security measures is critical to maintaining trust and operational integrity.

Cost Pressures and ROI Expectations - MROs are under constant pressure to optimize costs, which extends to their technology investments. Software providers must demonstrate clear and measurable ROI while keeping pricing competitive, often within constrained budgets.

Adoption of Emerging Technologies - The rapid pace of technological advancements, such as AI, IoT, and blockchain, presents both opportunities and challenges. Providers must continuously innovate to stay ahead but also ensure these technologies are practical, reliable, and easy to integrate into existing MRO workflows.

Global Market Complexity - Serving a global aviation market means navigating diverse operational requirements, cultural differences, and regional regulations. Software providers must adapt their solutions to meet the varied needs of MROs across different geographies.

The Transformative Impact of the Right Aviation Maintenance Software

Conversely, the right aviation-maintenance software can be a game-changer for aviation and MRO organizations. A purpose-built operations system integrates maintenance, inventory, and compliance workflows, creating a streamlined and efficient operation.

Cost optimization is another significant benefit. By automating manual processes and improving operational visibility, the right all-in one maintenance platform can help organizations reduce unnecessary expenses and allocate resources more effectively.

Regulatory compliance becomes a seamless process with the right system. In-built tracking and reporting features ensure that organizations can meet industry standards without the need for manual intervention. This not only reduces the risk of findings but also frees up staff to focus on more strategic initiatives, turning the operations into a proactive rather than reactive management.

Real-time visibility is perhaps the most transformative aspect of modern ERP systems. Advanced analytics and customizable dashboards provide decision-makers with the insights they need to make informed choices. For example, an MRO organization using predictive analytics can identify trends in maintenance data, enabling them to design a sales and operations planning model, optimizing the cohesion from their front-end to back-end operations, ultimately reducing turnaround-time.

Evolution of aircraft MRO software over the last 5 years

The evolution of aircraft MRO software over the past five years reflects a dynamic shift in addressing long-standing industry challenges. Many legacy solutions remain content with their existing capabilities due to the perceived complexity for MROs to migrate systems and are therefore not proactively keeping up with industry trends. “Why spend on new developments, when customers are locked in anyways!” Nevertheless, the industry has seen significant strides in innovation driven by both established players and new entrants.

A notable trend is the rise of startups founded by ex-Aviation and MRO executives and veterans who intimately understand the industry’s pain points. These innovators are bringing targeted solutions to market, addressing issues like workflow inefficiencies, supply chain bottlenecks, and technician productivity. Their insider perspective has fuelled a wave of purpose-built tools designed to overcome specific operational hurdles.

Predictive analytics and process automation has gained traction, enabling MROs to anticipate maintenance needs and reduce unplanned downtime. Procurement and RFQ (Request for Quotation) automation have also become industry staples, streamlining supply chain processes and driving efficiency across operations.

Cloud-based platforms are transforming how MROs interact with software. By ensuring all customers are on the same version of the software, these solutions eliminate the need for disruptive yearly version upgrades and reduce the risk of backend infrastructure failures. This seamless approach is particularly appealing to organizations looking for stability and scalability.

The past five years have been a period of transformation for MRO software, with a clear focus on efficiency gains, operational stability, and solutions that address real-world challenges. These advancements are paving the way for a more agile and resilient aviation maintenance ecosystem.

Key drivers behind the latest innovations in MRO software

The latest innovations in MRO software are being driven by a combination of industry challenges, technological advancements, and shifting market demands. Key drivers include:

Labor Shortages and Rising Labor Costs - The aviation industry is struggling with a significant shortage of skilled labor, coupled with rising labor costs. These pressures are driving MROs to optimize their indirect cost structures while increasing direct component touch-time to maintain profitability. Software solutions that streamline operations, enhance workforce productivity, and improve resource allocation are becoming essential to address these challenges.

Operational Efficiency and Cost Optimization - Rising maintenance costs and inefficiencies in manual processes are pushing Aviation organizations to adopt solutions that reduce turnaround times, optimize resource utilization, and enhance cost-efficiency. Automation and predictive analytics are helping MROs achieve measurable ROI by minimizing downtime and maximizing productivity.

Demand for Real-Time Data and Visibility - Real-time insights into operations, inventory, and workforce planning have become critical. MROs need tools that provide centralized, actionable data to make informed decisions, improve operational reliability, and enhance overall performance. “Green is good and red is great! Now we know what needs fixing!”

Supply Chain Challenges - Persistent issues like part shortages and fragmented supplier networks have led to advancements in procurement and RFQ automation. These tools streamline sourcing, improve inventory management, and enhance supplier performance, ensuring smoother operations and reducing disruptions.

Customer Expectations for Scalability and Stability - As MROs scale their operations, they require solutions that are stable, adaptable, and scalable. Cloud-based platforms offer seamless upgrades, consistent software versions, and reduced risks of infrastructure failures.

Regulatory Compliance and Quality Assurance - Meeting stringent aviation regulations while maintaining high-quality standards remains a top priority. Software innovations now integrate compliance management and quality assurance features, reducing risks and ensuring adherence to safety standards.

Insider-Led Innovation - Startups led by ex-MRO executives are driving purpose-built solutions tailored to specific pain points. Their deep industry knowledge has resulted in tools that directly address inefficiencies, workforce challenges, and operational bottlenecks.

Digital Transformation in Aviation - The broader push toward digital transformation has spurred the adoption of advanced technologies like machine learning, IoT, and blockchain. These innovations enable predictive maintenance, real-time tracking, and secure data sharing, further enhancing efficiency.

Focus on Workforce Optimization - With labor shortages and cost pressures, MROs are focusing on solutions that optimize workforce planning, cross-training, and skills development. Tools providing visibility into future workloads and automating workforce management are critical to addressing peak demand periods and maintaining operational stability.

Personalized and User-Centric Solutions - The need for intuitive, workflow-aligned software is reshaping the market. Tools like Aero NextGen’s Maintenance-Software Match Tool simplify software selection, enabling Aviation organizations and MROs to quickly identify solutions purpose-built for their unique operational needs.

The latest innovations in aviation maintenance software are being driven by the dual pressures of labor challenges and cost optimization, alongside the broader pursuit of efficiency, stability, and scalability. These advancements are equipping MROs to navigate an increasingly complex and competitive landscape while ensuring operational resilience.

Aero NextGen’s Customer Portfolio

The advantages of cloud-based MRO solutions compared to on-premise systems

Cloud-based MRO solutions are transforming aviation maintenance by offering significant advantages over traditional on-premise systems. These benefits include:

Seamless Upgrades and Scalability - Cloud-based platforms ensure all users operate on the same version of the software, eliminating the need for disruptive, time-consuming upgrades. This stability reduces the risk of backend infrastructure failures and allows MROs to scale operations seamlessly as their business grows.

Cost Efficiency - Unlike on-premise systems, which require significant upfront investments in hardware, infrastructure, and IT resources, cloud-based solutions operate on a subscription model. This reduces capital expenditures and lowers long-term IT maintenance costs, freeing up resources for other operational priorities.

Accessibility and Collaboration - Cloud solutions provide real-time access to data and workflows from any location with an internet connection. This accessibility enables better collaboration across teams, vendors, and stakeholders, ensuring faster decision-making and improved operational efficiency.

Data Security and Disaster Recovery - Leading cloud providers offer robust security measures, including data encryption, regular backups, and advanced threat detection, to safeguard sensitive information. Additionally, cloud systems ensure data recovery in the event of hardware failures or disasters, minimizing downtime and operational disruptions.

Improved Data Integration and Visibility - Cloud-based platforms enable seamless integration with other systems, such as ERP, supply chain, finance and payroll tools. This centralization of data improves visibility into operations, enhances decision-making, and provides actionable insights for continuous improvement.

Reduced IT Burden - With cloud solutions, MROs no longer need to manage complex IT infrastructure or allocate resources for system maintenance. Software updates, patches, and maintenance are handled by the provider, allowing MROs to focus on core operations.

Faster Deployment and Implementation - Cloud-based systems are quicker to deploy compared to on-premise solutions, which often involve lengthy installation and configuration processes. This allows MROs to start realizing the benefits of the software faster, accelerating ROI.

Flexibility with Remote Work - Cloud solutions support remote work environments, enabling technicians, planners, and managers to access critical systems and data from anywhere. This flexibility is particularly valuable for global operations and during unforeseen disruptions, such as travel restrictions or emergencies.

In all, cloud-based MRO solutions offer unmatched advantages in terms of flexibility, cost efficiency, and operational resilience.

The Aviation and MRO Software Landscape

The software market for aviation and MRO is diverse, with solutions catering to different needs and budgets. High-end systems like Ramco, AMOS, TRAX, IFS, and SAP offer comprehensive features for large organizations with complex workflows. Mid-tier solutions such as Quantum Control, Corridor, EmpowerMX, and Ultramain provide robust functionality for medium-sized businesses. Cost-effective options like AvSight, VistaSuite, Veryon, and Smart145 are ideal for smaller organizations looking to optimize operations without breaking the bank. Emerging players like ERP.Aero, PROMRO, CorePilot, Smart 145, and Airnxt are gaining traction for their innovative features and affordability.

Selecting the right operations system is a strategic decision that can make or break an aviation or MRO organization. While the wrong choice can lead to inefficiencies, compliance risks, and financial strain, the right operations system can drive operational efficiency, cost optimization, and long-term growth.

The Role of Aero NextGen’s Maintenance-Software Match Tool

Recognizing the need for tailored solutions, Aero NextGen launched a Maintenance-Software Match Tool for Aviation & MRO. This tool allows aviation professionals to complete a 3-minute survey and receive a report with the software solutions that are purpose-built for their unique workflow and operational needs – free! This marks a step forward in demystifying software selection and accelerating the adoption of technology.

Aero NextGen’s Maintenance-Software Match Tool will also show which operation systems are enabled by AI and machine learning to drive automation and decision-making, as well as those that are cloud-based.

This interactive quiz evaluates factors like company size, workflows, functional needs, and budget to recommend the best-fit all-in one maintenance platform. Backed by a comprehensive database of ERP contract details, modules, and pricing, the tool empowers organizations to make informed decisions. With over a decade of experience in aviation, Aero NextGen has a proven track record of delivering results and driving the industry forward.

To start your maintenance software selection journey, visit https://aero-nextgen.com/erp-finder-quiz.

About Aero NextGen

Aero NextGen is a brokerage for solutions in Aviation and MRO. We match Aviation companies and MROs to trusted technology solutions and services providers to solve systemic pain points. We become the trusted advisors to MROs looking to problem solve. Our mission is to advance aviation with smart solutions.

At Aero NextGen, we understand systemic challenges in the industry and work to bridge the gap between MROs and software providers. By partnering with vetted technology and service providers, we help MROs adopt solutions tailored to their unique needs. Whether it’s data analytics, process re-engineering, predictive maintenance, supply chain optimization, or workforce productivity tools, Aero NextGen matches you with the right solutions to future-proof your operations.

Our portfolio of customers includes the likes of Safran, Unical, SK Aerosafety Group, AJW, Top Aces, Fly Exclusive, IAG Aero Group, Aircraft Propeller Services, and more.

To learn more, visit www.aero-nextgen.com.